September 2012

.

Commentary

The Canadian housing market continues to remain steady. Forecasts from the Royal Bank of Canada call for “sustained growth in the economy, rising employment, and a much more supportive environment for the housing market than in the early 1990s.” However, the Canadian Association of Accredited Mortgage Professionals warns the typical Canadian borrower has taken on more interest-rate risk than their counterparts in the United States. In fact, one-third of all Canadian borrowers have elected to go with a floating-rate mortgage rather than the more traditional fixed-rate mortgage.

Many economists have warned that, barring external shocks, the Bank of Canada will likely begin to gradually increase interest rates beginning in 2013. With the expectation of rising rates, the benefits of floating-rate mortgages will wane and lead many to move from floating rates to fixed rates. A senior economist at the Royal Bank of Canada has seen just that. Over the past few months, there has been a shift from floating to fixed in anticipation of rising interest rates.

Even with anticipated changes to the market, the Canadian investor still has opportunities to maximize the potential of their dollar. And, right now, with historically low interest rates, it is still a great time to buy.

Housing Market

Home Sales

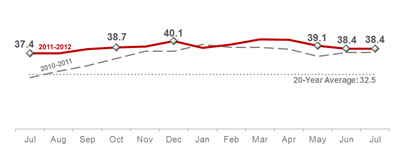

in thousands

Resale housing activity only fell 0.01% month-over-month, yet rose 2.78% year-over-year to 38,417 units. The relatively consistent number of sales is a continued sign of a stable Canadian housing market and economy. The 2.78% that we saw from 2011 to 2012 is a dramatic improvement in terms of stability, compared to what we saw for the same time last year where housing activity had jumped 18% from July 2010 to July 2011.

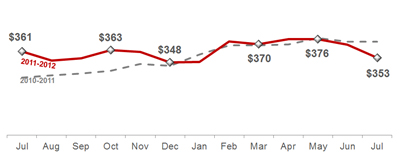

Average Home Price

in thousands

The average home price fell slightly to $353,147 in July, down 4.4% from last month and down just 2.24% from where it was this time last year. However, the average sales prices in roughly seven out of ten local markets actually saw a slight increase in July.

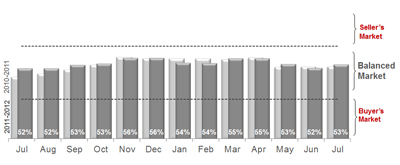

Inventory

Sales-to-Listings Ratio

The national housing market remained balanced in July at 53%, getting closer to a perfectly balanced market of 50%. This indicates a greater likelihood of steadiness in the coming months and is a good sign for the housing market moving forward, as it provides opportunity for buyers and sellers.

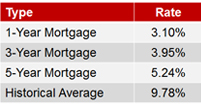

Mortgage Rates

Low interest rates are helping to keep home ownership within reach for most Canadians. When global recovery gains a stronger footing, rates are expected to increase to maintain inflation near the 2% target rate. For now, the low rates offer increased affordability for home buyers who buy while rates are low. 1, 3, and 5-year rates currently sit at 3.1%, 3.95%, and 5.24%, respectively.

Sources: The Canadian Real Estate Association (CREA), Royal Bank of Canada, Canadian Mortgage and Housing Corporation, Bank of Canada.

Special Reports

When looking to sell, your home’s appearance can be the difference between it sitting on the market or selling quickly. Updating your property can be one of the easiest and most cost-effective ways of adding value to your home. Here are some tips to get your house looking great:

- Perform the most common updates. On average,

someone who intends to sell their home spends about one-third of what

they would spend during their entire time in that home. The most common

updates are painting, flooring, and lighting—all of which have

cost-effective options.

- Make improvements. Improving your property can be

critical to selling a home. According to market research, only 23% of

the market sold were homes considered to be outdated while 76% were

fairly to very updated. Making improvements is one of the more

beneficial things a seller can do to help increase the appeal of their

home.

- Focus on the little things. Updating your house for sale doesn’t have to mean remodeling the whole place. Focusing on individual items that really need updating will make a big impact. Putting a fresh coat of paint or replacing old hardware on your cabinets could be the thing that helps get your house sold.

Source: KW Market Navigator

Contact me,

your local real estate expert, for information about what's going on in our area.

Don't forget to check out this month's video:

For a report with additional graphs, please see the This Month in Real Estate PowerPoint Report.The opinions expressed in This Month in Real Estate are intended to supplement opinions on real estate expressed by local and national media, local real estate agents and other expert sources. You should not treat any opinion expressed on This Month in Real Estate as a specific inducement to make a particular investment or follow a particular strategy, but only as an expression of opinion. Keller Williams Realty, Inc., does not guarantee and is not responsible for the accuracy or completeness of information, and provides said information without warranties of any kind. All information presented herein is intended and should be used for educational purposes only. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. All investments involve some degree of risk. Keller Williams Realty, Inc., will not be liable for any loss or damage caused by your reliance on information contained in This Month in Real Estate. |